A common issue in today’s society is how to combat pollution. With daily scares of global warming being pumped through the media, it is not a wonder that its a hot topic of the agenda of many governments, and rightly so.

Pollution, more commonly known to economists as a ‘negative environmental externality’ directly affects other agents’ welfare in the economy. This effect is not paid for. Carbon taxes and emissions trading are ways of dealing with this problem. Both essentially try to limit polluting by putting a price on doing so.

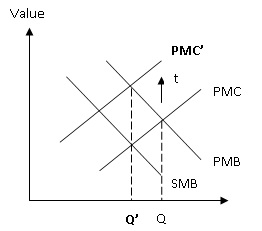

A Carbon tax (also known as a Pigouvian tax) is used to combat a negative externality by placing a tax on the polluter to raise their private marginal cost of production.

A simple analysis in the diagram above shows how they work. By placing a tax of ‘t’ on a producer (creating a negative externality), it raises their private marginal cost and reduces optimal output for the firm. In theory this will make the firm produce at the optimal for society (where PMC = SMB) as it is now paying for its pollution.

Professor Mankiw is one of the most prestigious advocates of carbon taxing, arguing that it could be sold politically by sugar coating it with a proposal to reduce some wide base tax (for example income tax)

Examples of carbon taxes in practise can be seen in Australia where the largest 500 emitters – the companies that emit more than 25000 tonnes of carbon dioxide get taxed for doing so. Another example from July 2010, is where India introduced a nationwide carbon tax of 50 rupees per tonne of coal produced and imported.

Emissions trading (also known as licenses) work in a different way to carbon taxes. They control the level of pollution directly by limiting the amount of licenses produced which corresponds to a target level of pollution. Licenses can be given or sold off at auction to the highest bidder. They legislate that externalities can only be generated if a license is held.

There are currently emissions trading systems in places such as Europe, Australia and New Zealand. The Kyoto protocol in 1997 is an international treaty in which certain developed nations agreed to legally bind targets for emissions of six major greenhouse gases. This then allowed for trading of permits (those companies which do not need to pollute as much can sell them onto those that do) and so created whats known as the carbon market.

So what are the pros and cons of each method of pollution reduction? The table below gives just a few of the issues that need to be considered:

| Benefit | Drawback | |

| Carbon Tax | Pigouvian taxes reach a broad base – you can tax fuel for exampleEarns tax revenue for the government which can be used for green projects.Informational advantage | High administration costsThere is no real safety net to protect low income earners against the tax from rising fuel prices etc so may be taken as a regressive tax.It cannot limit pollution to quantifiable levels. |

| Emissions trading | Directly sets a level of pollutionBecause of trading, it is used by those who need them the most and non-polluters can benefit through their sale.Automatically adjusts for inflation and price shocksEncourages a firm to reduce pollution and increase efficiency arguably more so than a carbon tax. | Costly – search costs, approval costs, insurance etc.Many activities rely on theoretical calculations which need third party checks – again mounting up the cost.Arguably more subject to political lobbying.May lead to price volatility on the energy markets. |